We may earn a commission for purchases through links on our site at no cost to you, Learn more.

- Varo Bank is not a prepaid bank; it is a full-service digital bank.

- Prepaid banks typically issue cards requiring preloaded funds with limited banking features.

- Varo Bank offers checking accounts, savings accounts, and direct deposit services.

- Accounts at Varo Bank are FDIC-insured up to $250,000.

- Varo Bank eliminates fees like overdraft and minimum balance charges.

- High-yield savings accounts are available, unlike prepaid banks.

- Varo Advance provides short-term, interest-free borrowing options.

- Budgeting tools within the Varo app support financial management.

- Varo Bank suits tech-savvy users seeking fee-free, modern banking solutions.

- Varo Bank’s services surpass the capabilities of prepaid banks in functionality and security.

Varo Bank has become a popular name in the world of digital banking. Many people searching for convenient, online financial services may wonder: is Varo Bank a prepaid bank? To answer this question comprehensively, we’ll explore what Varo Bank offers, how it works, and whether it aligns with the features of a prepaid bank. Let’s break this down into clear sections for a thorough understanding.

Is Varo Bank a Prepaid Bank?

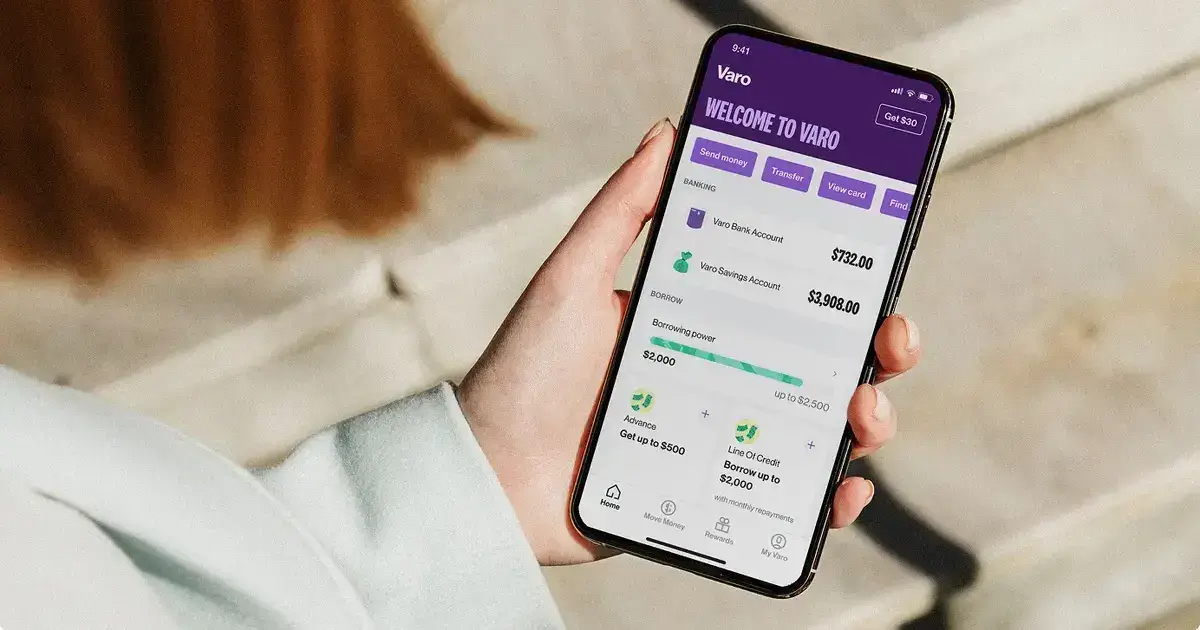

Varo Bank is an online bank that operates entirely through its mobile app and website. Unlike traditional banks with physical branches, Varo provides banking services digitally, making it accessible to tech-savvy individuals and those looking for modern banking solutions. Its streamlined services appeal to users who prefer managing finances on the go.

Before diving deeper, let’s address the central question: is Varo Bank a prepaid bank? The short answer is no. However, to fully understand why this is the case, we need to explore what defines a prepaid bank, how Varo operates, and what services it provides.

What Is a Prepaid Bank?

A prepaid bank generally refers to a financial institution or service that issues prepaid cards. These cards are not tied to traditional checking accounts and must be preloaded with money before use. They offer limited banking features compared to regular accounts, often focusing on payment convenience.

Prepaid banks typically don’t provide full-fledged financial services like direct deposits, savings accounts, or loans. Users rely on prepaid cards for specific spending purposes, and the funds are not insured by the FDIC unless linked to a partner institution.

How Varo Bank Differs from Prepaid Banks

1. Full-Service Banking Features

Varo Bank offers a range of banking services that go beyond what prepaid banks provide. It includes:

- Checking accounts with no monthly fees

- Savings accounts with competitive interest rates

- Direct deposit capabilities

- Early access to paychecks

These features make Varo Bank function more like a traditional bank than a prepaid service.

2. FDIC Insurance

Varo Bank accounts are FDIC-insured up to $250,000. This ensures that users’ money is protected in case of a bank failure. Prepaid banks often lack this insurance unless they collaborate with FDIC-insured institutions. Varo Bank’s insured accounts further confirm it’s not a prepaid bank.

Benefits of Banking with Varo

1. No Hidden Fees

Varo Bank eliminates many fees that traditional banks charge. Users don’t need to worry about overdraft fees, monthly maintenance fees, or minimum balance requirements. Prepaid banks often charge fees for loading funds, withdrawing cash, or even maintaining the account.

2. High-Yield Savings

Unlike prepaid services, Varo Bank offers savings accounts with attractive interest rates. Users can grow their money while enjoying easy access to their funds. This feature sets Varo apart from prepaid banks, which generally lack savings options.

Varo’s Innovative Features

1. Varo Advance

Varo Advance allows users to borrow small amounts of money (up to $250) without interest for short-term needs. This is a service prepaid banks don’t offer, as they typically focus on spending rather than lending.

2. Budgeting Tools

The Varo app includes tools for budgeting and financial management. Users can track their spending, set savings goals, and monitor their financial health directly through the app. Prepaid banks rarely offer such robust financial management features.

Why People Confuse Varo Bank with a Prepaid Bank

Some people mistakenly associate Varo Bank with prepaid banks due to its online-only model and digital-first approach. Varo’s reliance on mobile technology and its user-friendly interface might resemble the simplicity of prepaid card apps. However, the underlying services and functionality of Varo Bank are more comprehensive.

Who Should Use Varo Bank?

Varo Bank caters to individuals who prefer modern, digital banking over traditional branch-based services. It is especially suitable for:

- Tech-savvy users who manage finances online

- Those seeking fee-free banking options

- Customers looking for savings accounts with high interest rates

Varo Bank is not designed for users who need cash-focused services with no banking features, which is the primary purpose of prepaid banks.

Frequently Asked Questions

Here are some of the related questions people also ask:

What is Varo Bank known for?

Varo Bank is known for being a fully digital bank that offers fee-free checking and savings accounts, budgeting tools, and early direct deposit access.

Is Varo Bank considered a prepaid bank?

No, Varo Bank is not a prepaid bank. It is a full-service, FDIC-insured online bank offering comprehensive financial services.

Does Varo Bank offer prepaid cards?

No, Varo Bank does not issue prepaid cards. It provides checking accounts with debit cards linked to the account balance.

What’s the difference between a prepaid bank and Varo Bank?

Prepaid banks offer prepaid cards with limited features, while Varo Bank provides full banking services like direct deposits, savings accounts, and FDIC insurance.

Is Varo Bank safe to use?

Yes, Varo Bank is safe to use. It is FDIC-insured, meaning customer deposits are protected up to $250,000.

Can you save money with Varo Bank?

Yes, Varo Bank offers high-yield savings accounts that help users grow their money efficiently.

Does Varo Bank charge fees like prepaid banks?

No, Varo Bank has no hidden fees such as overdraft charges, monthly maintenance fees, or minimum balance requirements.

Who should choose Varo Bank over a prepaid card?

Varo Bank is ideal for individuals seeking a modern banking experience with tools for saving, budgeting, and managing their finances digitally.

How does Varo Bank’s mobile app compare to prepaid card apps?

Varo Bank’s app offers advanced features like budgeting tools, savings goal tracking, and account management, which are more comprehensive than most prepaid card apps.

The Bottom Line

To sum up, is Varo Bank a prepaid bank? The answer is no. Varo Bank is a full-service, digital bank offering checking and savings accounts, direct deposits, budgeting tools, and FDIC insurance. It far exceeds the capabilities of prepaid banks, providing users with the benefits of modern banking without the limitations of prepaid services.

Varo Bank’s offerings align closely with what consumers expect from traditional banking institutions, only delivered in a digital-first format. While it may share the convenience and accessibility of prepaid banks, its range of features, account types, and protections firmly establish it as a true online bank.

If you’re looking for a banking option that’s both accessible and comprehensive, Varo Bank is worth considering. For those who need a simple spending tool without additional services, a prepaid card might be a better fit. However, Varo Bank stands out as a strong choice for anyone seeking a modern banking experience.